Health insurance payroll deduction calculator

Taxpayers can choose either itemized deductions. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

Payroll Tax Calculator For Employers Gusto

Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication.

. All Services Backed by Tax Guarantee. Ad Payroll So Easy You Can Set It Up Run It Yourself. Subtract 12900 for Married otherwise.

Compare Now to Save. Choose Deduction and click Next. 2000 300 1700 After deducting the health insurance premiums the employees pay.

Small Business Health Insurance Is Complicated eHealth Is Here to Help. All Services Backed by Tax Guarantee. 24 Paychecks In this method Zenefits calculates deductions for bi-weekly employees as if they were semi-monthly 24 pay dates in a year so that monthly.

Ad Get Personalized Health Insurance Quotes with Affordable Costs in Minutes. Choose the Payroll Item button and click New. Say Ricky earns 1000 per pay period in gross wages earnings before paycheck deductions.

2022 Federal income tax withholding calculation. He contributes 30 per pay period for health insurance costs. This Payroll Deductions Calculator will help you to determine the impact that changing your payroll deductions can have on your financial situation.

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Its a simple four-step process. Determine your taxable income by deducting pre-tax contributions.

Payroll Deductions Calculator Use this calculator to help you determine the impact of changing your payroll deductions. 2022 Federal income tax withholding calculation. Ad Compare This Years Top 5 Free Payroll Software.

Payroll Deductions Calculator Use this calculator to help you determine the impact of changing your payroll deductions. 2022 Top Health Insurance Plans Coverage. This calculator uses the 2016.

Ad Explore Plans From 1300 Small Business Health Insurance Plans From 70 Carriers. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Use this calculator to help you determine your net paycheck.

Health Insurance POP etc. You can enter your current payroll information and deductions and. Free Unbiased Reviews Top Picks.

Assume that the cost of a companys health insurance plan is 300 per biweekly pay period and that the employee is responsible for paying 25 of the cost through payroll withholding. Subtract 12900 for Married otherwise. It will confirm the deductions you include on your.

A paycheck calculator allows you to quickly and accurately calculate take-home pay. So before withholding any taxes deduct 300 for the pre-tax health insurance. The standard deduction dollar amount is 12950 for single households and 25900 for married couples filing jointly for the tax year 2022.

You can enter your current payroll information and deductions and. Try changing your withholdings filing status or retirement savings and let the payroll deduction calculator show you the impact on your take home pay. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Select Custom Setup and click Next. You can enter your current payroll.

Go to the Lists menu and select Payroll Item List.

How To Calculate Medical Deductions In Payroll

Are Payroll Deductions For Health Insurance Pre Tax Details More

How To Calculate Payroll Taxes Wrapbook

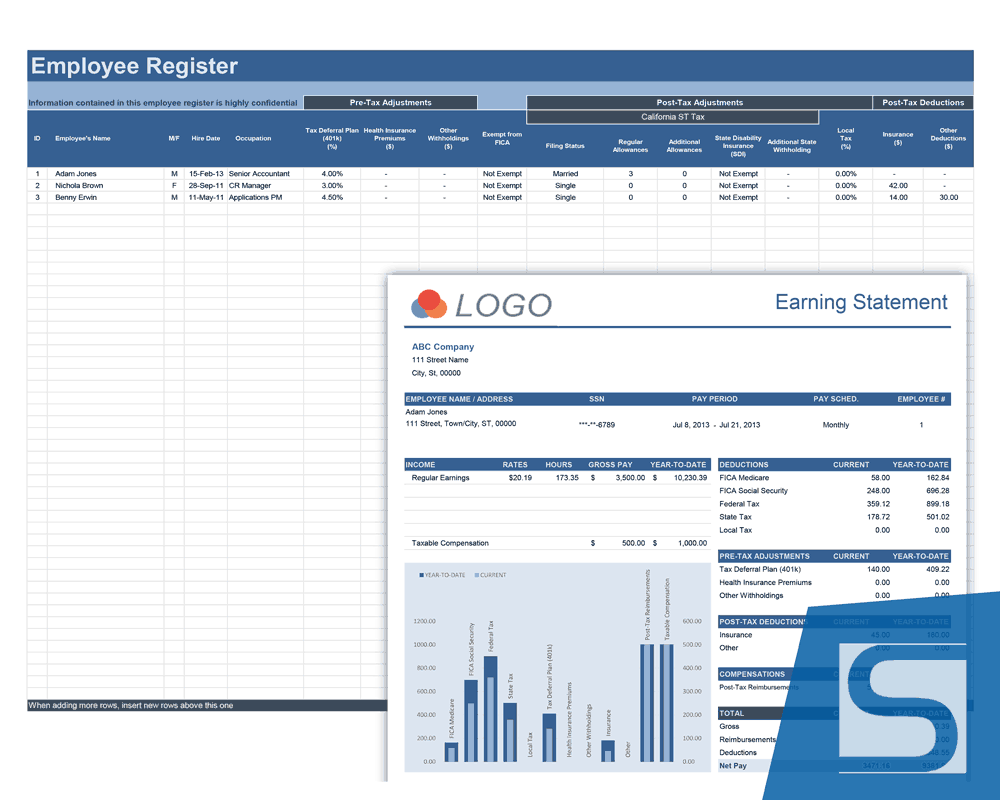

Payroll Calculator With Pay Stubs For Excel

Free Online Paycheck Calculator Calculate Take Home Pay 2022

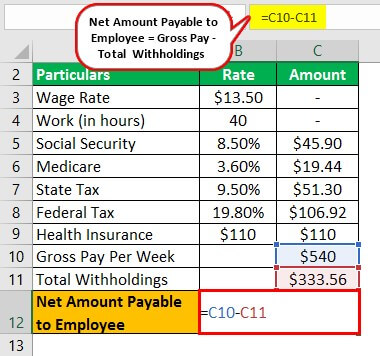

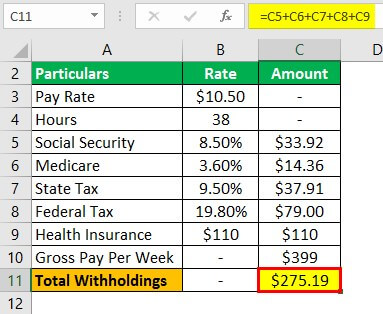

Payroll Formula Step By Step Calculation With Examples

Payroll Formula Step By Step Calculation With Examples

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

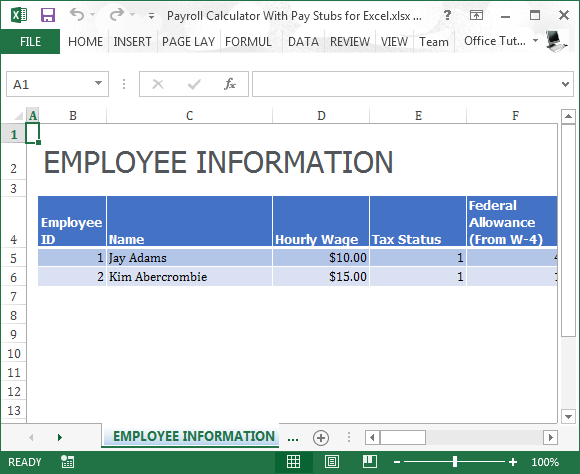

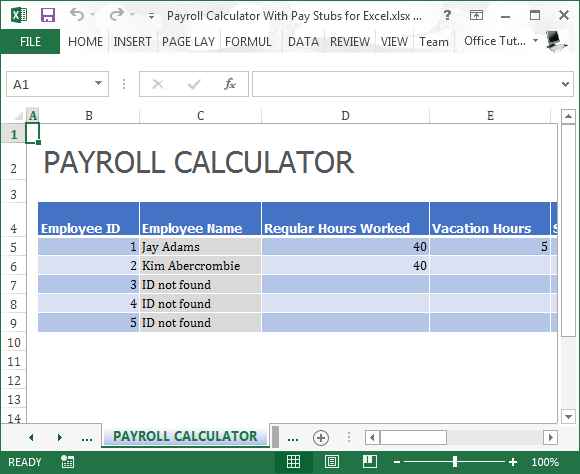

Payroll Calculator With Pay Stubs For Excel

Payroll Calculator With Pay Stubs For Excel

How To Calculate Federal Income Tax

Paycheck Calculator Take Home Pay Calculator

Payroll Tax What It Is How To Calculate It Bench Accounting

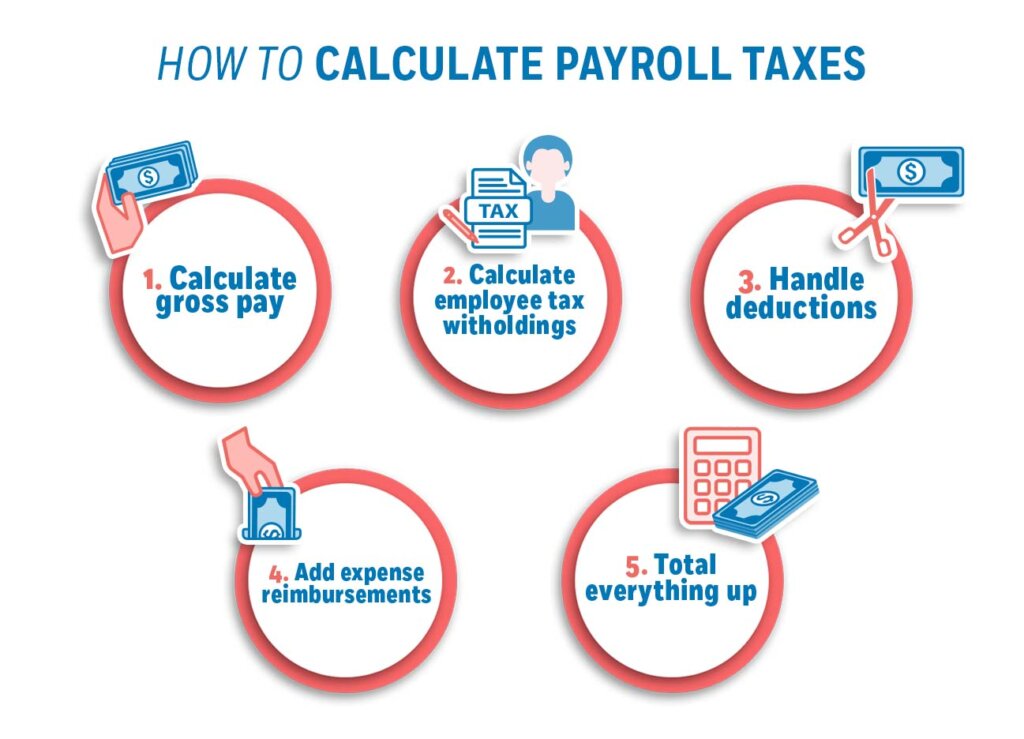

How To Calculate Payroll Taxes In 5 Steps

Payroll Calculator Free Employee Payroll Template For Excel

Paycheck Calculator Take Home Pay Calculator

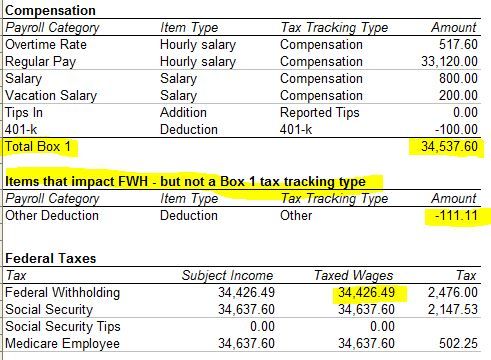

Solved W2 Box 1 Not Calculating Correctly